N.C. Market overview for law students provided by Abshire Legal Search & Consulting.

The state of the market is healthy. The N.C. offices of AmLaw 200 firms had a strong 2021; so did leading regional firms and boutiques. 2022 has started strong as well, although there are signs of transactional work slowing.

Fifty AmLaw 200 firms have a presence in North Carolina. Fourteen of those have more than one office in the State. Thirty-nine have an office in Charlotte; and twenty-four have an office in Raleigh.

The two major sub-markets in N.C. are Charlotte and Raleigh. Broadly speaking, AmLaw 200 firms have been more interested in Charlotte to date, largely due to the headquarters or core presence of several major banks (Bank of America, Wells Fargo, Truist, and others). Several AmLaw 200 firms have opened in Charlotte specifically in finance and have had little interest in diversifying past that.

Broadly speaking again, the Raleigh market has a stronger venture capital scene due to innovation originating out of the universities in the Triangle (Duke, NC State, UNC). There are several non-AmLaw firms that have developed robust corporate practices in Raleigh (Hutchison Law Group; Smith Anderson; Wyrick Robbins), representing companies through their growth cycle, in addition to representing more established companies.

Generally, billed rates (and associate compensation) are somewhat lower in Raleigh than in Charlotte, and M&A and finance command higher rates than litigation across markets.

Regional firms and the N.C. offices of AmLaw 200 firms often opt out of the interview programs of highly-ranked out-of-state schools because they have not received enough interest from students to justify the time and expense (and not because they are not interested in these students). Most firms will welcome inquiries/applications from students from these schools.

There are several regional firms that should be on your radar (Brooks Pierce; Moore & Van Allen; Parker Poe; Robinson Bradshaw; Smith Anderson; Wyrick Robbins). The best resource for identifying firms with market-leading or well-regarded practice areas is Chambers and Partners.

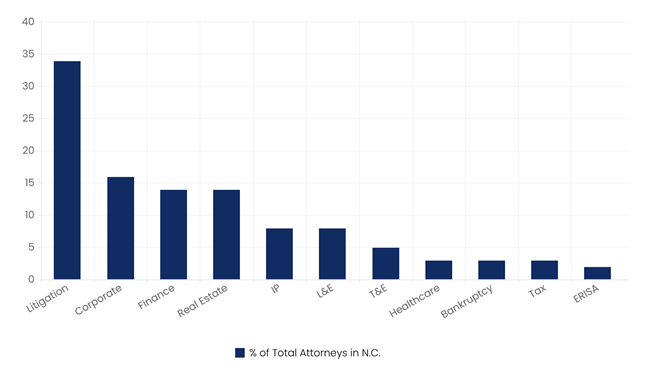

Practice Areas

Below is a headcount ranking by practice area as a percentage of total attorneys in N.C. By “total”, I am referring to attorneys at a range of law firms from AmLaw 200 to small firms that populate the database of Firm Prospects, a resource that many recruiters subscribe to and that is intended to be a comprehensive list of attorneys at law firms that typically provide legal services to businesses and corporations.

The percentages do not change much when limiting the data set to AmLaw 200 firms, except that: (1) Litigation drops from 34% to 25%, reflecting the price sensitive nature of litigation and the fact that not all litigation matters are “bet-the-company” matters. (2) Finance jumps from 14% to 23% reflecting the fact that many AmLaw 200 firms came to Charlotte specifically for finance and have not developed full-service offerings since launching.

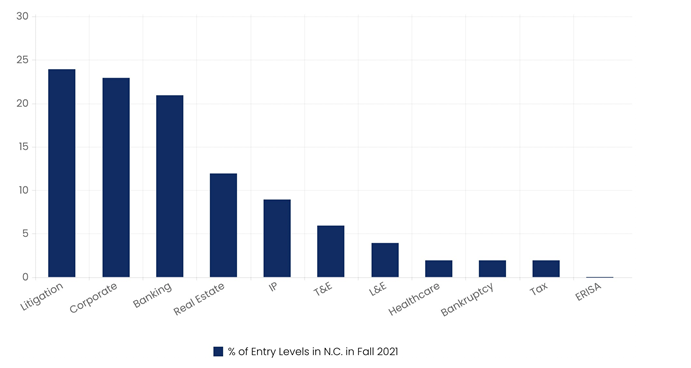

It is also worth noting to which practice areas entry level associates have been assigned recently. Below is a headcount ranking by practice area as a percentage of total attorneys in N.C. who started as entry levels in Fall 2021.

The percentages change in a few material ways when limiting the data set to AmLaw 200 firms: (1) Litigation drops from 24% to 15%, again reflecting the price sensitive nature of litigation; (2) Finance jumps from 21% to 33% again reflecting the fact that many AmLaw firms came to Charlotte specifically for finance and finance has been busy the past few years; (3) Corporate headcount %s are similar, highlighting the fact there are several robust Corporate/M&A practices in firms outside of the AmLaw 200, and they have also been busy.

Litigation Trends

Despite leading in total headcount, there have been far fewer lateral associate openings in litigation over the last year, and anecdotally litigators have not been as busy as their co-workers in transactional practices.

Litigation practices in the AmLaw 200 have shrunk across markets over the last couple decades, largely due to outsourcing of document review to alternative legal service providers. Although this is good news for associates who do not want to do doc review, it has limited the number of litigation opportunities at AmLaw firms for partner-track associates. Also, litigation partners in AmLaw 200 firms in North Carolina face significant rate pressure from regional and boutique firms who can offer lower rates to clients. That said, 25% of lawyers in AmLaw 200 firms in North Carolina are in litigation, so there is still opportunity.

Law students interested in litigation should summer and start in North Carolina. Well- credentialed lateral litigators seeking to relocate from other markets have had difficulty landing a role over the last decade. Hiring firms typically prefer lateral litigation candidates who have experience with the local courts and judges. Also, associates in North Carolina handle a broader range of matters (not just bet-the-company matters), which allows them to get more substantive experience at an earlier stage (taking depositions, arguing motions); this gap in experience widens as associates become more senior.

Transactional Practices

M&A, finance, and real estate have had the most lateral searches arising from growth (i.e. increasing headcount, not simply replacing lawyers who left).

Much of the work at AmLaw 200 firms in Charlotte is driven by servicing the banks. Finance / capital markets practices are lucrative but demanding. There is always demand for more associates.

There always seems to be a shortage of real estate associate talent. Students interested in real estate should consider regional firms as well. The local nature of real estate suits regional firms with strong local connections; and AmLaw 200 partners in real estate have challenges competing with these firms on rates.

Trusts & Estates

There are never enough associate candidates for lateral searches in Trusts & Estates, Tax, and Employee Benefits. Generally speaking, those practices tend to be steadier and less demanding when measured against the late-nights required by deal closings and trial preparation. Many Trusts & Estates lawyers in North Carolina are nearing retirement, just as the demand for their services is increasing as Baby Boomers age. Trusts & Estates also offers a BigLaw off-ramp to small firm or solo practice.

Exit Options

Of the 240 associates who left law firms in North Carolina over the last 12 months, 202 went to other law firms. 30 went in-house, 4 took government positions, 3 started judicial clerkships, and 1 became a recruiter.

Of those who moved to law firms, 77% stayed in-state. In the current environment of remote poaching of associates, it is not always clear whether associates physically relocated to another state or simply affiliated with an out-of-state office. That said, D.C. (6%), N.Y. (3%), and South Carolina (2%) were the most common destinations of North Carolina associates.

Of those who went in-house, all but 5 found positions in-state. The large banks provide a law firm off-ramp, even for litigators, who typically do not have as many opportunities to go in- house as transactional lawyers.

Advice

Reach out proactively to the local recruiting contact of your top 5 firm choices. In parallel, reach out to any fellow undergrad or law school alumni in that office; any LinkedIn contacts who are connected to lawyers in that office (and ask for an introduction); and any law school alumni in other offices (and ask for any information on the N.C. offices and / or introductions to N.C. attorneys).

Follow-up with the recruiting contact at least every other week. Messages get buried. If you do not receive a response from the recruiting team, follow-up with the office Managing Partner, or a local partner in your practice area of interest.

Consider scheduling a trip to North Carolina. Then, let the firms know that you will be in town. It shows genuine interest in that location. Ask if they can meet for coffee or if you can stop by the office, even if they are not hiring. Let them know that you would like to make the connection regardless; it shows interest and you will be top of mind when they decide to hire.

Be able to answer the questions: “Why North Carolina?” and more particularly “Why Charlotte or Raleigh?”.

Be candid with a firm about your practice interest during the interview process.